Single Invoice Level Financing (ILF)

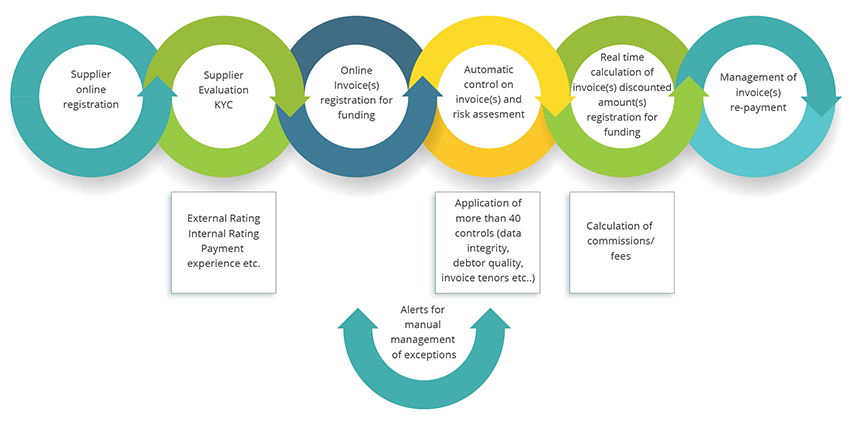

Whether it is called transaction financing, single invoice discounting, invoice level financing, one time financing, selective financing or otherwise, whenever decisions are made not on the basis of the global value of a collateral, but on an item-by-item basis, this falls into the product category supported by iMX under its ILF capability.

ILF is totally integrated in iMX Commercial Finance, allowing financial institutions to benefit from a system in which they can propose both ILF contracts and traditional portfolio-based receivables finance contracts, and much more.

The strong points of the iMX ILF feature are:

Invoice Level Financing in iMX

- Real-time calculation of the fundable amount per invoice, funded amount, costs per invoice, etc.

- Reporting to clients on all movements at invoice level

- Automatic redistribution of the dilution amount occurring on a funded invoice to other not yet funded invoices

- Possibility to handle credit notes

- Etc.

And of course, the entire range of the iMX rich features set is available for Receivables Finance activities.

It is worth highlighting here the importance of the iMX Analysis and Decision module for the operational and statistical reporting on ILF contracts, from pre-sales to aftercare.

For a deeper dive into iMX Commercial Finance capabilities, download our brochures: iMX Commercial Finance, Accounts Receivable Financing in iMX, iMX Commercial Finance Extranet and iMX Analysis and Decisions – Commercial Finance.