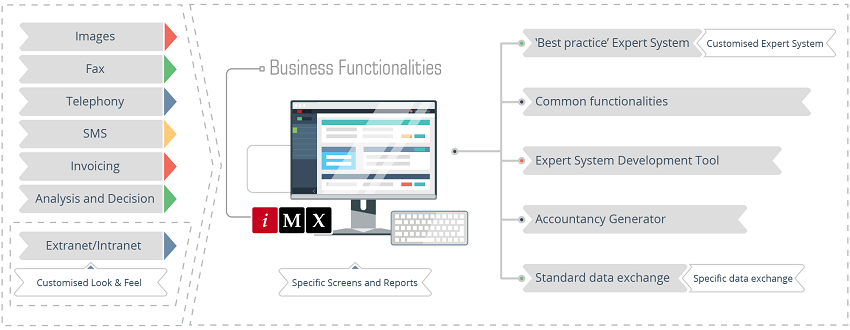

Amicable debt collection in iMX

iMX comes with all business procedures necessary for debt collection at the various stages called ‘amicable’:

- “Without incident”: Managing cases in which no incident has occurred with the possibility to put preventive dunning into place

- “Amicable”: Managing unpaid invoices with the possibility to adopt a graduated approach to debt collection by type of debt and client

- “Event of default/termination”: Managing contract breaches with all related accounting consequences (outstanding principal, contractual or termination indemnities…)

Adopt a customized approach and test your dunning strategies

iMX is equipped with tools which allow you to optimize your amicable debt collection processes, leaving you free to parameterize your strategies/segments: organize the dunning timeframes and stages of the amicable debt collection plan, or adapt the mode of communication according to the case/product or any other criteria present in the system (internal/external scoring, payment habits, aging, etc.).

iMX also offers a tool for comparing and optimizing (champion/challenger) debt collection strategies in terms of recovery and costs.

Cost management

Control and anticipate debt collection costs depending on the strategies applied. Through the Restructuring/Renegotiation function, iMX allows you to renegotiate payment schedules, as well as restructure a client’s debt.

Case structure allowing complete follow-up of the debt collection process

iMX allows for rigorous follow-up of all actions taken to recover a debt. Financial elements which make up the debt, parties (internal and external) involved in the lifecycle of the case, documents which have been sent and received (dunning letters, statements, contracts, etc.): iMX provides visibility and complete monitoring of each case.

Receivables outsourcing

iMX allows you to follow the outsourced management of the receivables by entrusting them to external service providers: amicable bailiffs, external debt collection agencies, specific missions entrusted to a service provider, etc.

The features offered by the software allow:

- The automatic determination of the parties competent to manage the case based on various criteria integrated into the system and prioritized according to the case: geographical, type of receivables, etc.

- The management and monitoring of the external service provider to ensure the case progresses and the mission that has been entrusted to them is properly executed.

- The management of purchase orders and the verification of the invoices of the designated external parties involved.

For a deeper dive into “iMX Debt Collection” functionalities please download our iMX Debt Collection and Legal brochure.