iMX Commercial Finance supports any type of receivables financing

- Factoring

- Invoice discounting

- Self-allocation factoring (Shadow ledger)

- Bulk financing, e.g. financing of borrowing base certificates grouping together receivables either at buyer level or portfolio level

- Disclosed or undisclosed deals

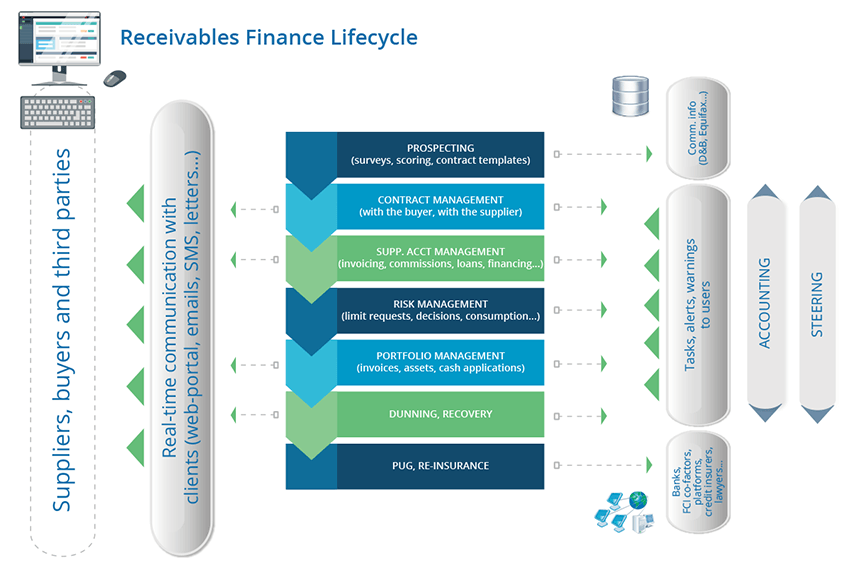

iMX covers the entire lifecycle for each product:

- The pre-sales (prospecting) process embedded in iMX, and supported via iMX Extranet (web portal for clients)

- As stand-alone products or as part of a multi-collateral facility (same client account or in different client accounts under the same contract)

- Extensive KYC capabilities for clients (suppliers) and buyers, including links to external data providers such as Dun&Bradstreet, Equifax, etc.

- Advanced risk management powered by iMX’s scoring engine and API-based integration with major credit insurers (Atradius, Euler Hermes, Coface, and others). iMX supports both synchronous and asynchronous message flows, enabling real-time and batch limit management across more than 50 limit types and levels.

- End-to-end monitoring of invoice financing, with automated controls and filtering applied at the point of receivable integration through seamless system-to-system data exchange

- Detailed handling of multiple invoice sampling criteria monitored at contract level

- White labelling in all system components

- Real-time availability calculation (also applicable to Extranet clients)

- More than 45 predefined interest, cost and fee items (and flexibility to create new ones)

- The most complete set of debt collection tools available in any factoring system

- Club deals/syndication: Waterfall or proportional, as an agent/leader or as a member

- Fully automated end-of-day and end-of-month processes

The iMX web portal (iMX Extranet) for clients, bank branch users and funding partners (such as funding partners in club deals or Fintechs) plays an essential role in the success and efficiency of receivables financing. The web pages have been customized (the data displayed, color diagrams, etc.) to help clients make appropriate decisions.

Of course, the full range of the iMX rich features set is available for receivables financing activities. It is worth highlighting here the importance of the "iMX Analysis and Decision" module for operational and statistical reporting on receivables financing activities, from pre-sales to debt collection.

To learn more about iMX Commercial Finance, download our brochures: Commercial finance (Factoring) – Main functionalities in iMX, Accounts Receivable Financing in iMX, Extranet for Commercial finance in iMX, iMX Analysis & Decision (Factoring), Transportation Factoring in iMX.