Debt Collection - Possibilities for preventive action offered by iMX

Benefits of preventive dunning strategies:

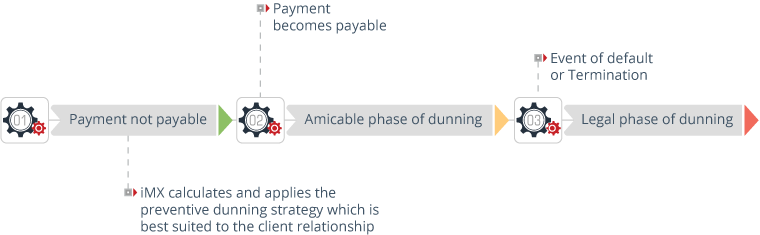

Preventive dunning takes place several days before a payment falls due (due date of an invoice, rent, loan or credit card authorization).

It aims to anticipate payment incidents before the due date and allows you to:

- Remind the client to deposit sufficient funds in their account before it is debited.

- Identify possible disputes before the expected payment date.

- Avoid any possible oversights when the expected payment is made.

Preventive dunning strategies which are fully customizable:

iMX is packed with great customization features, thanks to its advanced Scoring and segmentation tools, not to mention the option to adapt preventive dunning strategies to the situation at hand.

- Scoring and segmentation allow you to:

- Identify the cases requiring preventive dunning, depending on:

- Your client’s creditworthiness

- The characteristics of your receivables

- Any past failures to make a payment when dealing with the client or in respect of the receivables.

- Put into place preventive dunning only for the cases which require it. It may take place for a specific period of time or throughout the period of the contract.

- The customization of dunning strategies allows you to:

- Define when preventive dunning should occur (typically 3–15 days before the due date).

- Use the most appropriate communication channels, including fully integrated, automated notifications via external systems, while still supporting traditional options (email, phone, SMS).

- Tailor all messages to the specific customer situation.